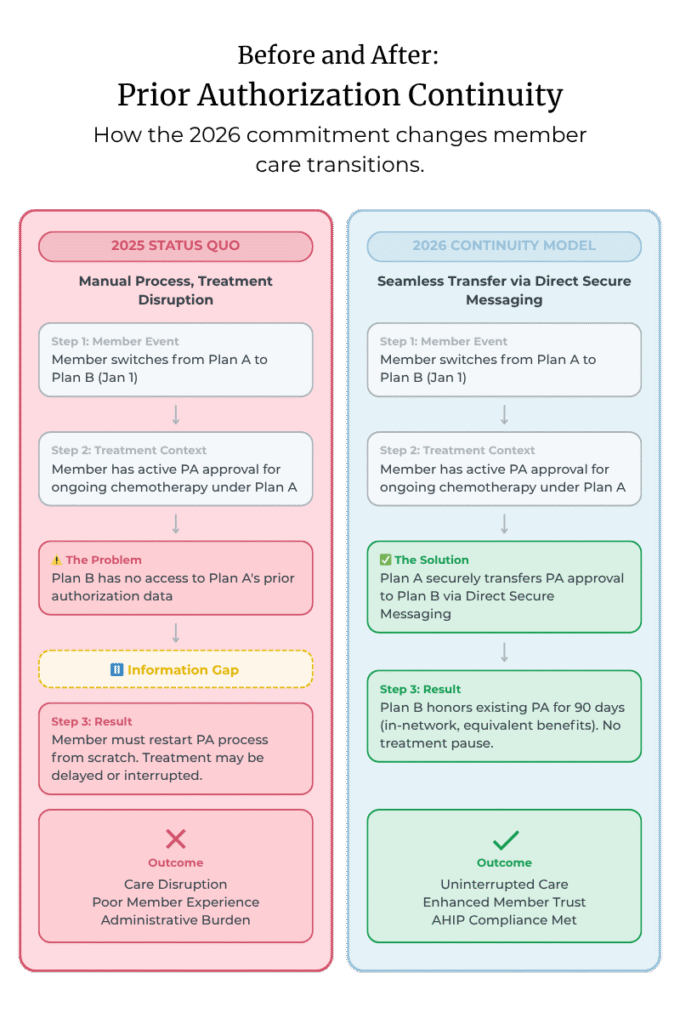

In 2025, AHIP and the Blue Cross Blue Shield Association introduced six industry commitments designed to make prior authorization simpler and more patient-friendly. One of these, the Continuity of Care commitment, focuses on what happens when a patient changes insurance while they’re in the middle of an ongoing treatment.

Starting January 1, 2026, when a member transitions to a new health plan, the new plan must honor existing, in-network prior authorization approvals for 90 days. The goal is straightforward: keep care moving and avoid disruptions that occur when clinical authorization information doesn’t transfer smoothly between payers.

This concept is already familiar in Medicare Advantage and some Medicaid programs, and now it expands to commercial plans. The big question for payers is practical: What’s the most efficient way to exchange prior authorization information plan-to-plan—quickly, securely, and with minimal disruption?

The Real Challenge for Health Plans

Most plans want to support members through care transitions, but operations are messy. Prior authorization data often lives in multiple systems and isn’t always exchange-ready. While the CMS Interoperability and Prior Authorization Final Rule outlines payer-to-payer FHIR APIs, not all commercial plans must implement them—and many will still be early in deployment by 2026. Practically speaking, plans are looking for something: already available, trusted, fast to implement, and compatible with existing workflows.

This is where Direct Secure Messaging comes into focus.

Why Direct Secure Messaging Just “Works”

Direct Secure Messaging provides a secure, standardized, established way to exchange clinical and administrative information between organizations. It’s been used for care coordination for more than a decade and doesn’t require major new infrastructure to start. It’s a practical pathway for payer-to-payer data exchange that can support continuity of care and prior authorization portability—including documents, clinical summaries, and FHIR attachments—with minimal disruption.

What Plans Need and How Direct Supports It

- A trusted way to exchange Protected Health Information (PHI) → Direct operates within validated identity and security frameworks.

- Flexibility with formats → Documents, clinical summaries, even FHIR attachments.

- Minimal workflow disruption → API-integrated or user-driven options.

- Timely implementation → Can be rolled out well before January 2026.

Where DataMotion Fits In

DataMotion is an EHNAC-accredited HISP and a founding member of DirectTrust™. We helped build the trust framework that underpins secure exchange. We’ve supported payers, providers, HIEs, and care coordination networks for years—so this is familiar ground.

We help plans:

- Establish payer-to-payer Direct Secure Messaging pathways.

- Validate identities and routing via the DirectTrust network.

- Integrate send/receive into care management workflows.

- Pilot in a sandbox before scaling.

- Expand sustainably across trading partners.

All without major system changes—or waiting on API availability.

A Practical Rollout Path

| Alignment & Design | Map the Continuity of Care handoff; agree on data elements and routing. |

| Sandbox Exchange | Test send/receive; validate workflow and endpoints. |

| Controlled Rollout | Start with 1–2 plan partners; ensure staff and systems are comfortable. |

| Scale & Sustain | Expand to more partners; support volume and performance. |

This approach meets compliance timelines and leaves room to evolve toward FHIR-based models at your pace.

Supporting Members Without Adding Complexity

The Continuity of Care commitment is ultimately about people in the middle of treatment. The good news: the tooling already exists. Direct Secure Messaging gives payers a secure, familiar, practical way to exchange the necessary prior authorization information—on time for 2026. Given DataMotion’s deep roots in the DirectTrust network, we can help you adopt the workflow with confidence and clarity.

Frequently Asked Questions

What exactly changes on January 1, 2026?

New plans will honor existing, in-network prior authorization approvals for 90 days when a member switches plans—preserving continuity of care during transitions.

Do we need full payer-to-payer FHIR APIs in place to comply?

Not necessarily. Many commercial plans won’t have mature FHIR deployments by 2026. Direct Secure Messaging offers a secure, widely available exchange pathway that works with current systems.

What formats can we exchange via Direct?

Documents, clinical summaries, and even FHIR attachments, depending on your workflow.

How quickly can we stand this up?

Direct can be rolled out before 2026 and integrated through APIs or user-driven workflows to minimize disruption.

What’s a sensible rollout plan?

Align on the handoff process → sandbox test → controlled rollout with 1–2 partners → scale and sustain.