Self-service started long ago with things like the self-service gas pump (1947) and automated teller machine (1967) – primarily for economic reasons. Self-service often helps to reduce the cost of doing business, and when it comes to digital self-service – is available 24×7. But ever since the introduction of online banking and online brokerage services, the idea of “self-service” has become increasingly more important – particularly in financial services. Account holders want online access to view a balance, initiate payment transactions, buy investments or to check credit account charges – from portals and smartphone apps. A perfect self-service arrangement – convenient and efficient for both the consumer and the business. But every self-service process can reach its limit – and then customers want an equally effective communication channel to get help. That’s where a secure message center becomes a key link between efficient self-service and efficient customer service.

What is a secure message center?

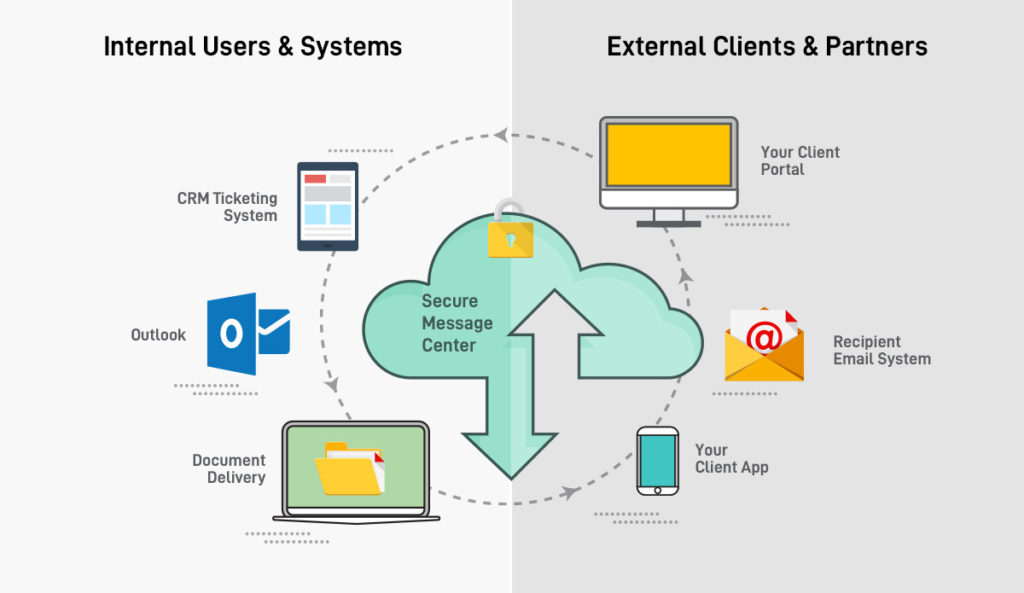

A secure message center adds web-mail, web-form or web-chat services natively to financial services self-service customer portals or apps so that clients can easily ask questions about their account and even share supporting files or images (receipts for a credit charge dispute, a tax return as part of a loan application process). Client messages and files are routed to responsible employees – account teams, support personnel, or contact center agents for a response. Case numbers may be assigned for tracking in ticketing systems, and response notifications are sent via email or SMS text channels to notify customers of a waiting reply. For security and regulatory compliance reasons, the message content (and any uploaded file or image attachments) must use encryption for security, and detailed logging and tracking reports which provide history and proof for compliance audits.

How is a secure message center enabled?

Enabling an efficient secure message center requires an assessment of the workflows end-to-end. What type of inquires are expected? Can they be categorized for efficient routing? What is the log-on process to use it? How should the secure message center look? What type of message features does it need? What type of file attachments do customers need to upload and share? Which employees need to respond to messages? What type of applications and user interfaces will the employees use to receive messages? There’s a litany of questions that will drive the design and requirements for the secure message center – all centered around making the communications workflow as seamless and efficient as possible.

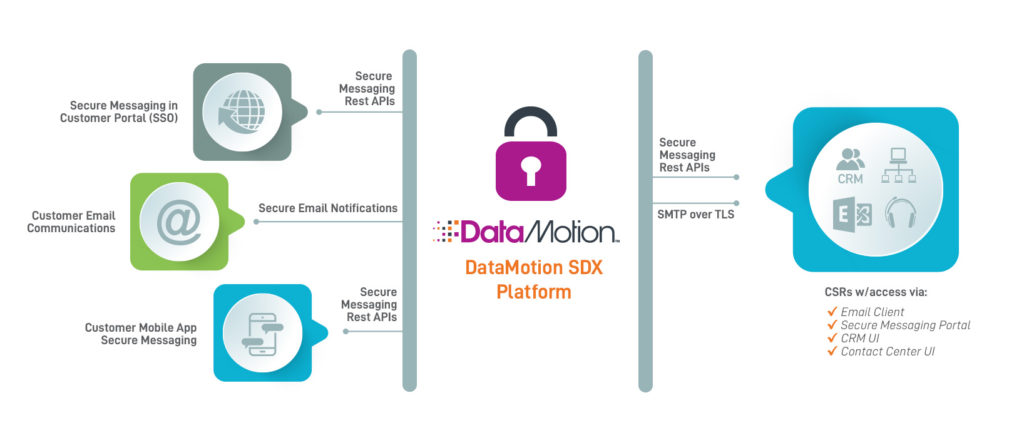

Figure: Secure Message Center architecture

How should customers access a secure message center?

Secure message centers have evolved from traditional email encryption services, which provide similar security and tracking features, but generally force users to create a separate login on a separate web-portal to send or receive secure messages. By contrast, an integrated secure message center shares a financial services portal login (via SSO techniques) at a minimum, and at best – blends seamlessly into the service portal’s user interface. Taken a step further – corresponding mobile apps can be offered as an alternative to web portal access and the secure message center features and functions are replicated in the mobile app as well. Under the hood – this requires a secure messaging service that supports SSO services and exposes web service APIs for the secure messaging service functions, management and provisioning. This simplifies the addition of secure message center features in financial services self-service portals and mobile apps.

How do employees access the secure message center?

For account management and lower volume, or ‘un-categorized’ inquires – an email client such as Outlook may be most suitable. For high volume, contact center workflows, employees will often use a CRM like Salesforce Service Cloud to manage the customer database, automate and track customer interactions for support and retention – even for marketing and sales touchpoints. So, the secure message center must integrate with the backend applications and UIs that your employees use, while maintaining end-to-end message security and verifiable compliance with security policy and privacy regulations – always ‘must have’ table stakes of a secure message center design for financial services firms.

The benefits to digitally integrating and transforming your self-service customer portal

By updating your self-service customer portal and mobile apps with a secure message center, you can transform the way you and your customers/clients work together. Your customer feels enabled to easily do business with you. Your response and outreach are more complete and efficient. And, your business can often reduce costs. A win-win for everyone. This solution is a notch on the belt of “digital transformation” and how to improve the interaction between clients and your customer teams that respond to their needs.

Want to learn more about how to secure workflows in self-service customer portals? Visit us at the DataMotion Developer’s Center, financial services solutions page or Contact Us for a consultation.